are taxes cheaper in arizona than california

The state sales tax in Nevada is 46 which is 265 lower than its neighbor to the west. If you hate the beach you might find Arizona and Nevada to be more attractive than Southern California.

Pros And Cons Of Moving From California To Arizona Californiamoversusa

It depends on the car and the dealership but Arizonas sales taxes are lower than California.

. Therefore you should check your states transportation agency or DMV website when determining the. States may have specific charges in addition to the registration and title fees below. Its effective property tax rate is 247 not much higher than the 227 in Illinois.

Below is a table of each states registration and title fees. 51 rows Arizona has the lowest registration fee of 8 but the state adds a 32 public safety fee. Payroll taxes are a significant factor to consider too.

Residents of the coastal state have to pay almost twice more of the state income tax. California also imposes employment training tax with current ETT rate at 01 State disability insurance tax SDI at 09. Income Tax Rates In 2022 single taxpayers with incomes of up to 27272 in Arizona will see a 255 income tax rate while those earning more than that will have to pay 298.

Homeowner No Child care Taxes Not Considered. Are taxes cheaper in Arizona than California. Top rate dropped from 66 to 59.

Arizona and Nevada both offer great entertainment options for outdoor lovers. In California single tax filers earning up to 9326 will pay 1 those earning between 9326 and 22107 pay 9325 plus 2 of the amount over the minimum and those earning. New Hampshires effective tax rate is 218 with Connecticut the only other state with a property tax of over 2 214.

For more information about the income tax in these states visit the Oregon and California income tax pages. A permanent reduction of Colorados flat individual and corporate income tax rates changed it from 463 to 455. Are taxes cheaper in Arizona than California.

The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homesThe average effective tax rate in the state is 062 which is well below the 107 national average. According to Bloomberg Arizona taxes are much lower than California taxes. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are.

Like in California different cities and municipalities often add in local sales taxes. Californias supply issues began in August when a fire broke out at a Chevron refinery in the Bay Area. For an in-depth comparison try using our federal and state income tax calculator.

Arizonas tax system has vastly different impacts on taxpayers at different income levels. This bring the highest possible total sales tax in Nevada to 8375 which is still over two percent cheaper than Californias highest rates. An individual income tax surcharge of 35 was put in effect for taxpayers with marginal income above 250000 single filers or 500000 joint filers.

Between the tax relief and lower cost of living we are economically much better off than when we were in CA. Arizona has cheaper taxes does not demand the pricey blend that California does has a diversified supply of gasoline and has not experienced the recent supply disruptions that have plagued its neighbor to the west. Arizona individual income tax rate is 454 while Californians need to pay 93.

From Bloombergs look at state taxes. None The tax burden in Arizona is small compared to that of other states because of its lower-than-average property taxes so the decline in home prices has hit Arizonas municipalities harder than those in many. Are taxes cheaper in Arizona.

For instance the lowest-income 20 percent of Arizonans contribute 13 percent of their income in state and local taxes considerably more than any other income group in the state. 537300 1552 more Utilities. The five states with the lowest top marginal individual income tax rates are.

66 Property tax per capita. Tax Rates in both these states differ greatly. California Income Taxes are Twice as Much as Arizona Income Taxes.

As this years tax-filing deadline April 18 comes closer its. The fact that New Hampshire doesnt have an income tax on wages isnt good for the average taxpayer. But its still far lower than Californias rate of 133 which is the highest in the nation followed by Oregon at 99 and Minnesota.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Home Subjects Math Science History Arts. For income taxes in all fifty states see the income tax by state.

Compare these to California where residents owe almost 5 of their income in sales and excise taxes and just 076 in real estate tax. Arizona individual income tax rate is 454 while Californians need to pay 93. As youll see in the heat map below the Tax Foundations data shows that Hawaiis marginal tax rate is one of the higher rates in the nation at 825.

CA has some of the highest taxes in the Nation personal income tax rates are roughly double of AZs and Gas taxes are higher also But you do get more benefits. New Hampshire rounds up the list of the top three states with the highest property tax. This tool compares the tax brackets for single individuals in each state.

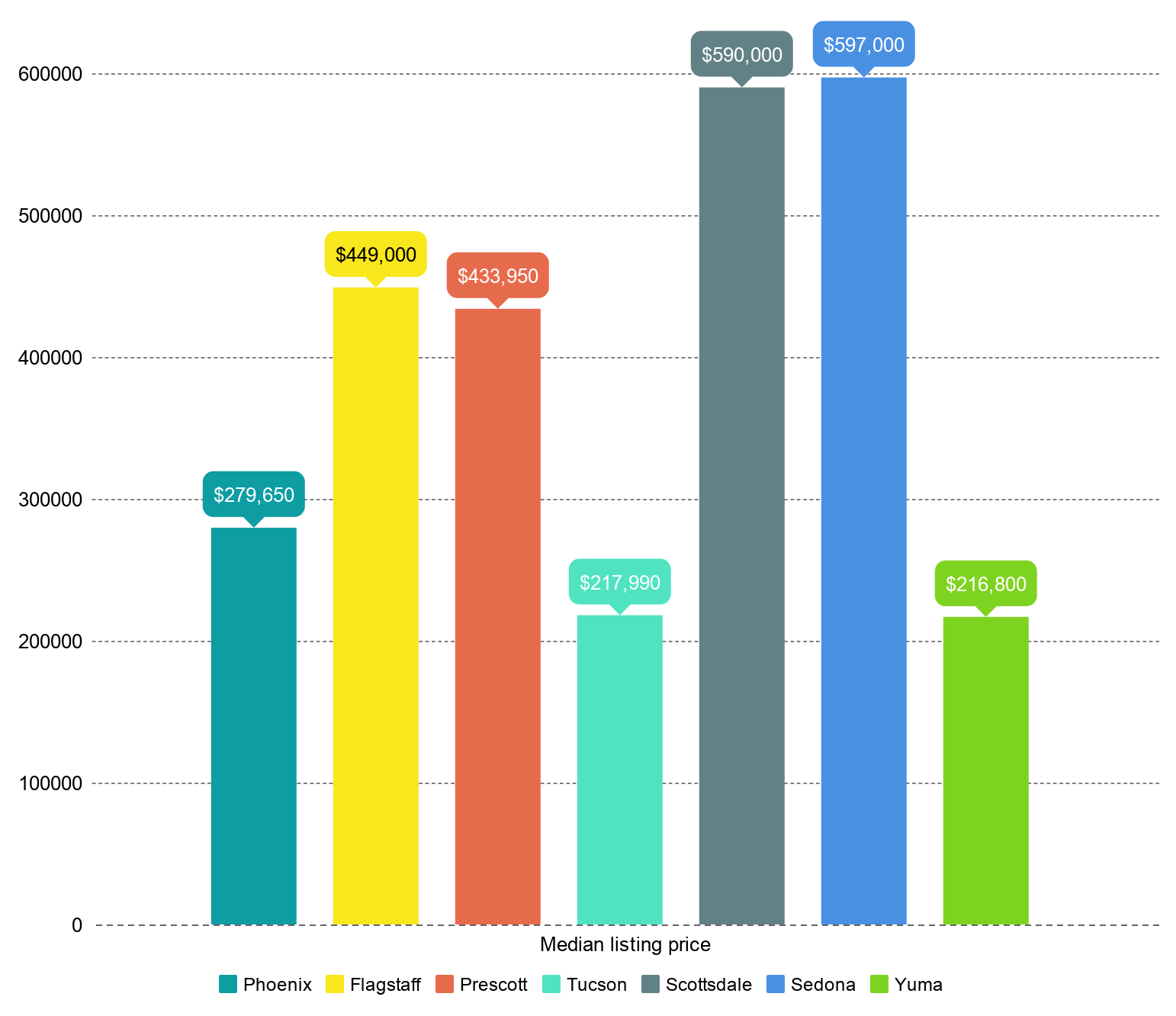

State sale tax is also lower in Arizona being 660 in comparison with 725 in California. In December we moved form CA to AZ and have not looked back. So in addition to getting a ton more house for your money in Arizona if you move to Arizona youll save a ton on taxes each and every year you live here.

California has one of the highest state unemployment tax rate with minimum UI tax rate from 15 vs. Instead it relies more on property taxes which arent based on a taxpayers income. In fact it is tied with Texas as.

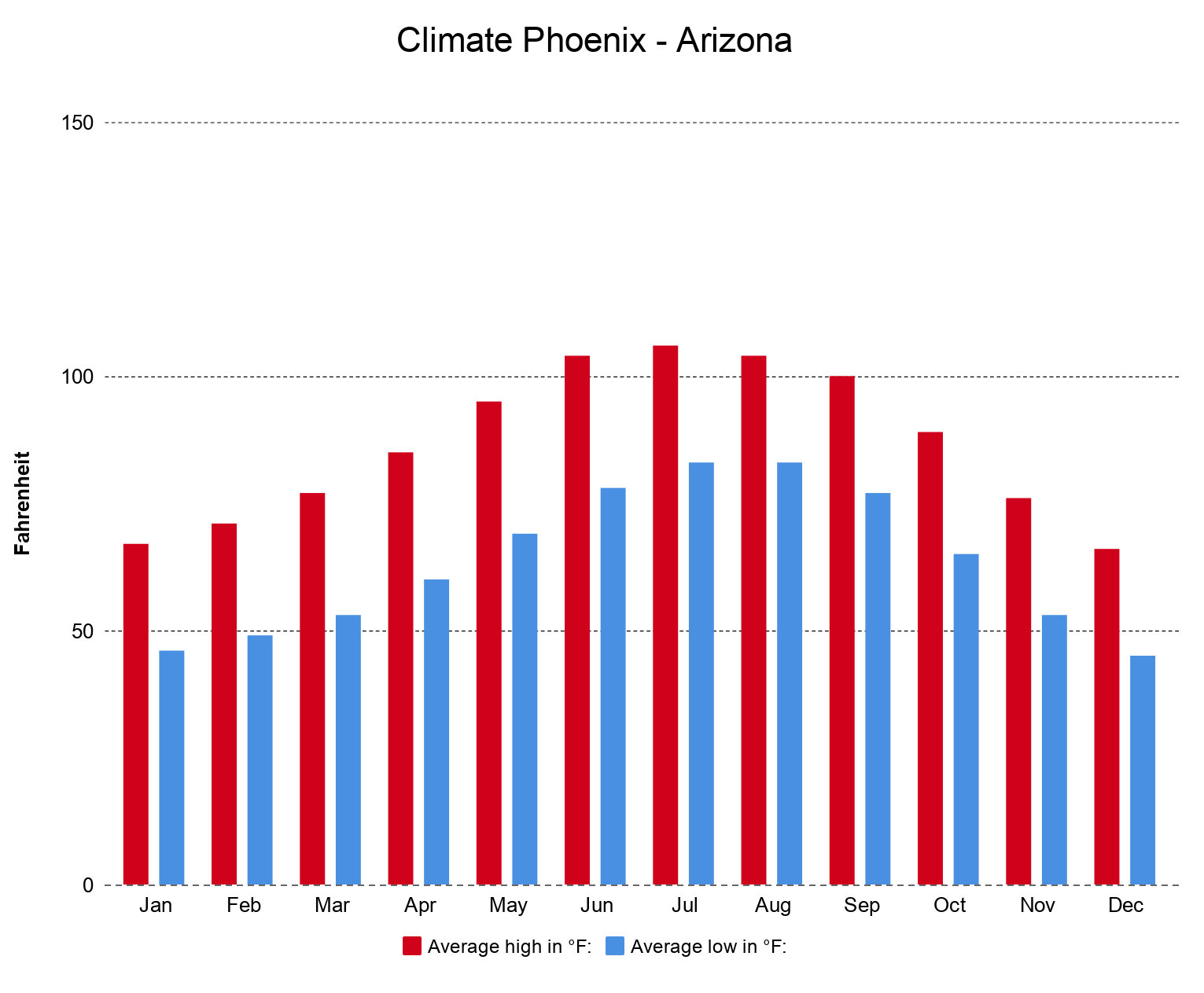

The largest city in Arizona is Phoenix and it has professional sporting teams restaurants museums and art galleries. One example of course is income tax rates. So if youre a middle-income person youll pay a smaller portion of your income in state and local tax in Massachusetts than in New Hampshire.

For low-income families Arizona is far from being a low tax state. State sale tax is also lower in Arizona being 660 in comparison with 725 in.

Pros And Cons Of Moving From California To Arizona Californiamoversusa

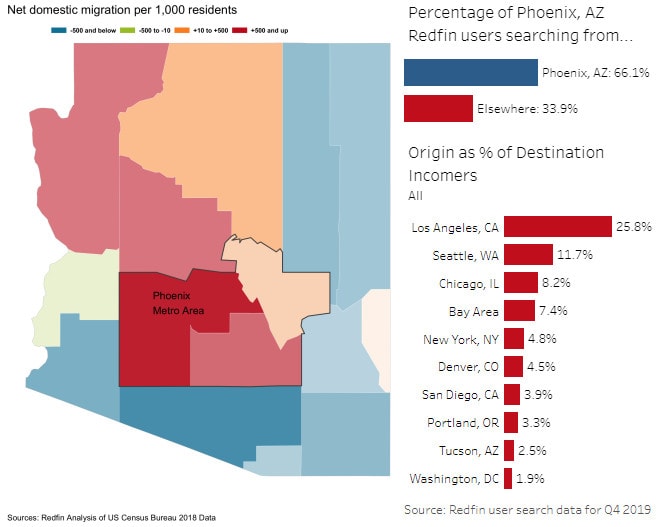

Reasons Why Everyone Is Moving From California To Phoenix Arizona Living In Phoenix Az

Living In California Vs Living In Arizona Youtube

Where Does Arizona Rank In Cost Of Living Az Big Media

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Get In Touch With Us To Look At Cheap Land For Sale Near Me In California Arizona Land For Sale Mohave County Cheap Land For Sale

Free 50 States Studies Elementary Moving Tips States And Capitals United States Map

How To Move From California To Las Vegas In 2021 Moving To Las Vegas Las Vegas Visit Las Vegas

California To Arizona Movers Cost 2022 Movebuddha

State Corporate Income Tax Rates And Brackets Tax Foundation

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Reasons Why Everyone Is Moving From California To Phoenix Arizona Living In Phoenix Az

Top Rated Arizona Pool Builder California Pools Landscapes Small Pool Design Pools For Small Yards California Pools

Never Underestimate The Power Of A Canadian Girl Who Lives In California Shirt In 2021 Canadian Girls Michigan Shirts Arizona Shirts

Arizona State Taxes 2022 Tax Season Forbes Advisor

Arizona Amasses Californians And The Political Climate Is Changing

Moving From California To Arizona Benefits Cost How To

Double Door 012 In 2022 Iron Doors Wrought Iron Doors Front Entrances Wrought Iron Doors